rethinking the 60/40 portfolio and the "risk-free" rate (here's what i'm doing instead)

I used to think markets were rational.

I spent the early years of my career as an investment manager. Passed the CFA back when the Institute was still called AIMR (yep, that’s how long ago it was). Worked alongside some of the sharpest value fund managers in Australia. Studied all the legends, like Warren Buffett, Peter Lynch, and Benjamin Graham.

But here’s the uncomfortable truth I’ve realised: even the best active managers don’t really know where the market’s going.

If you had relied solely on fundamental analysis over the past 15 years, you would’ve struggled to make sense of the market and drastically underperformed in a world flooded with printed money. I've come to realise traditional models are broken. Beyond fundamental analysis, you also need to account for:

Market sentiment and narratives

Capital rotation

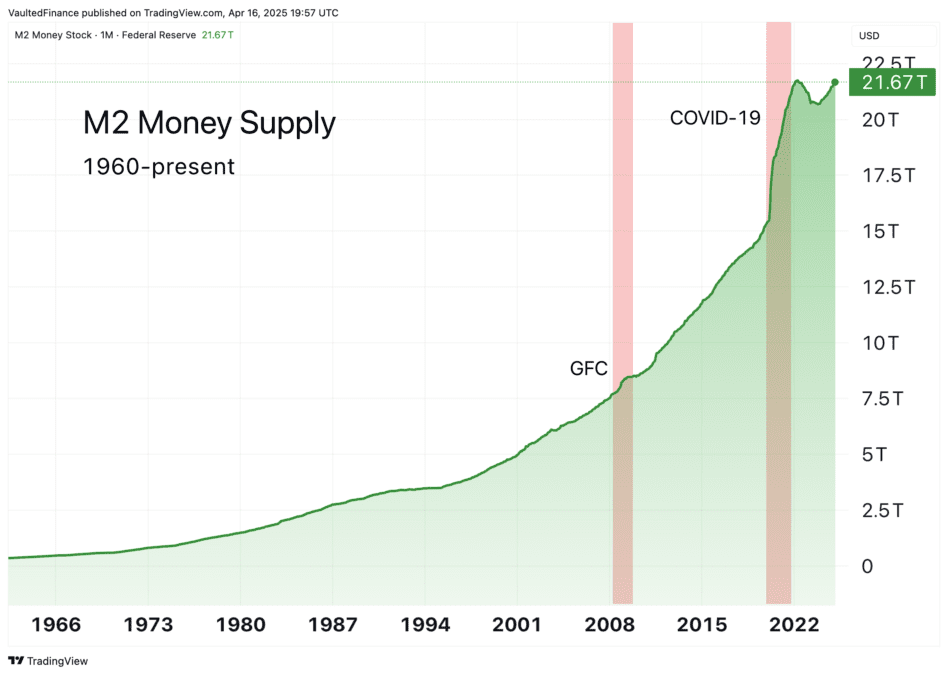

M2 money supply growth

Geopolitics and new world order cycles

These are now major vectors to consider for any serious asset allocation strategy.

Why the Traditional 60/40 Portfolio Is Long Dead

The traditional 60/40 portfolio allocates:

60% to equities (for growth)

40% to bonds (for stability)

It was the go-to model for decades.

But post-2008 when we had the Great Financial Crisis and the US bailed out the banking system, this model is long outdated and completely irrelevant. When central banks print trillions, inflation rises. Higher inflation means higher interest rates. And higher rates crush bond values.

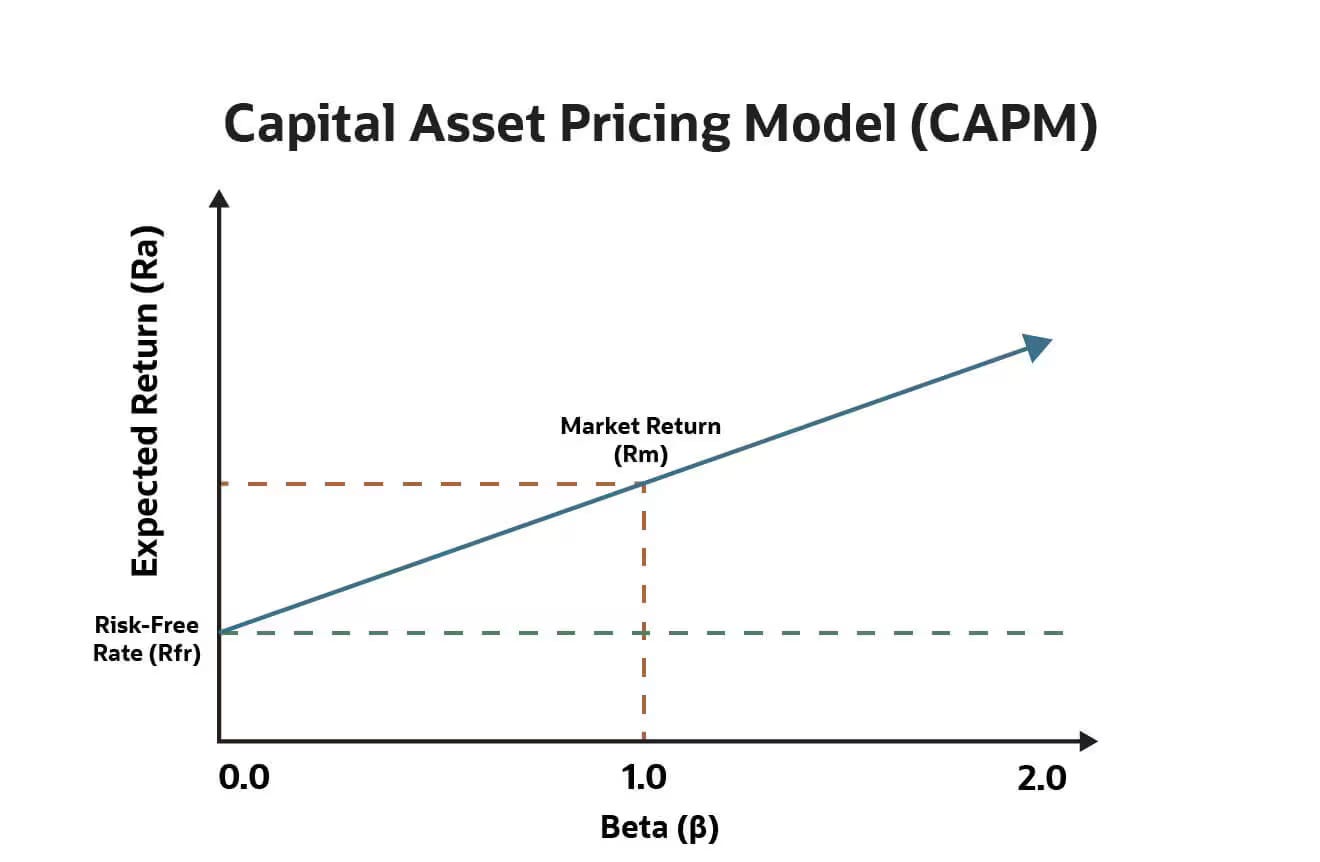

One of the fundamental tenets you learn in the CFA curriculum is the Capital Asset Pricing Model (CAPM):

Expected Return = Rf + β(Rm − Rf)

Where:

Rf = risk-free rate (typically government bonds)

β = beta (volatility relative to the market)

Rm = expected market return

(Rm − Rf) = market risk premium

In other words, if you want more return you need to take more risk.

But here’s the catch: government bonds are no longer “risk-free”.

If you invested 40% of your portfolio in government bonds over the past few years, you might’ve collected a 3-5% yield, but your principal dropped by 20-30%. Whoops. There goes your "safe" return. Instead of being a “risk-free return”, bonds are more like “return-free risk”.

In other words: owning bonds today might be riskier than owning stocks.

The US Today (July 2025): Still Risk-Free?

Let’s look at the facts for the US today:

Sovereign credit rating: AA+ (S&P), Aa1 (Moody’s) - no longer AAA

National debt: $37+ trillion, while GDP is $30+ trillion/year

Debt-to-GDP: ~120%

Annual interest payments: >$1 trillion (more than 20% of federal revenues)

Current account deficit: ~$800 billion/year

Now ask yourself: does this sound like a risk-free nation?

And that’s without even mentioning America’s eroding ability to project power, as China gains control over strategic resources like rare earths that are so critical for defense and technology.

US Treasuries are no longer risk-free. Bonds are no longer “safe.”

Ramit Sethi's Diversified Investment Portfolio: A Simpler Framework

I’ve always admired Ramit Sethi’s minimalist approach. He advocates:

90/10 allocation (stocks/bonds) for younger investors

Slowly increasing bond exposure as you age (e.g., 55 = 69/31, 65 = 53/47)

Instead of picking individual equity stocks, use 2-3 market ETFs instead (US, international, bond)

Automating contributions and rebalancing once a year

It’s clean. It’s simple. There’s a certain elegance to just buying the S&P 500 index fund, paying very low expense ratios, earning around 9-11% annually, and casually outperforming most active fund managers after fees. Add in the Rule of 72, and with the magic of compounding, you’re doubling your money roughly every 7 years.

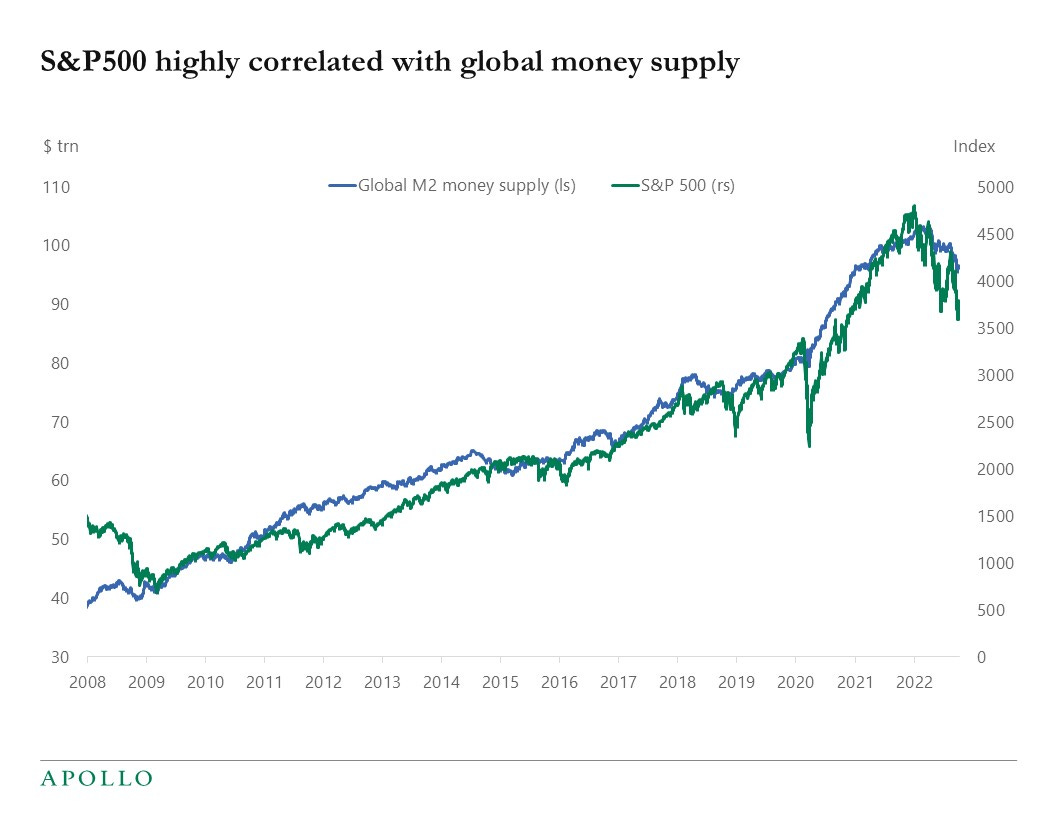

But even this clean, passive framework is starting to feel incomplete in today’s macro environment. At a market nominal growth rate of 9-11%, this simply matches the rate at which M2 global money supply is growing. You're not building any real incremental wealth, you’re just meeting the market beta benchmark.

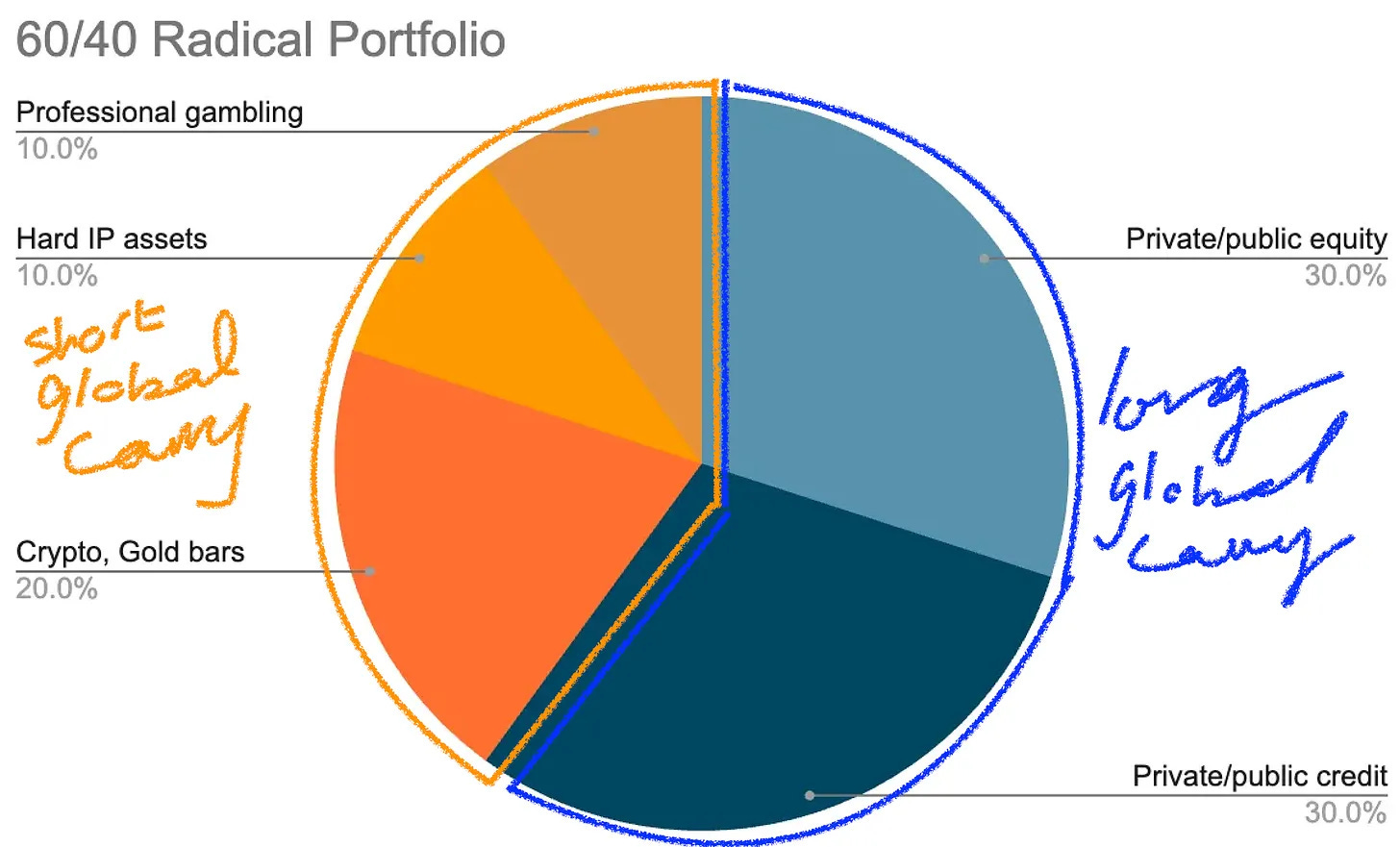

Jeff Park’s Radical Portfolio

Enter: The Radical Portfolio Theory by Jeff Park.

Instead of 60/40 in stocks and bonds, Park proposes a new lens:

60% Compliance: Traditional, state-aligned assets like equities, real estate, and institutional holdings

40% Resistance: Decentralised or state-resistant assets - Bitcoin, physical gold, art in private custody, biotech IP, even Pokémon cards, sports betting, and prediction markets

This portfolio is designed for a world where fiat systems are increasingly unstable and centralised control is tightening. In Park’s words, resistance assets preserve optionality and independence.

I like the split between compliant and resistant capital. I like the inclusion of Bitcoin which provides significant alpha to any portfolio by being state-resistant.

But what I don’t love is the illiquidity of many “resistance” assets. Pokémon cards, fine art, or prediction markets often require niche domain expertise to value correctly. If you’re deeply engaged in these domains, then great. But if not, you’re competing without an edge.

Personally, I prefer assets that are liquid, transparent, and accessible - where you can enter and exit without friction, and don’t need to be an expert to avoid overpaying.

My Current 75/25 “Contrarian Portfolio”

The Capital Asset Pricing Model (CAPM) was developed in the 1960s, well before the era of aggressive central bank money printing - which started in 2008 during the Global Financial Crisis. As such, in a world of rampant money printing, we need to redefine this formula and re-think the risk-free rate.

The risk-free rate is no longer the yield on a 10-year US Treasury. It’s the rate at which fiat currency is being debased - measured by M2 money supply growth.

Since 2008, that’s averaged 9-11% annually. As shown earlier, the S&P 500 has compounded at a similar rate over the last 15 years - so that would just match the rate of monetary debasement, let alone beating it. So this should be the minimum hurdle your portfolio should aim to beat, not just a US treasury yield.

So here’s my updated rule:

Your portfolio must beat the rate of monetary debasement.

And there’s only one asset that sits outside the fiat matrix - with a fixed supply, no dilution, and no central control:

Bitcoin.

Everything else, stocks, fixed income, real estate, etc sits on a fiat foundation that is melting at the rate of monetary debasement.

In a strange way, Bitcoin may now represent the true "risk-free rate" and minimum hurdle rate. It’s both growth and defence. Not because it’s without volatility, but because it’s the only asset that isn’t melting underneath you. It represents the risk-free rate, because it doesn’t sit on a fiat foundation that gets debased. And it also represents the highest alpha security, because fiat has no ceiling (unlimited demand) and Bitcoin has a fixed supply.

Here’s how I’ve constructed my own investment portfolio:

70-80%: Outside the Fiat Matrix (i.e. the “don’t touch” long term portfolio)

Hard monies (Bitcoin and gold)

20-30%: Inside the Fiat Matrix (i.e. the “itchy-finger” short term portfolio)

ETFs, stocks (thematic investing, swing trading and options trading)

Any excess returns from the 30% get funnelled back into Bitcoin/gold or used to pay for large discretionary lifestyle expenses (e.g. travel, TVs, and house renovations)

My investment thesis today reflects a barbell approach between long-term conviction and short-term flexibility. 75% of my portfolio sits “outside the matrix” in assets like Bitcoin and gold that are resistant to state intervention, inflation, and monetary debasement. This is my “don’t touch” portfolio.

The remaining 25% is “inside the matrix” - a more active, liquid mix of ETFs, equities, and options. This is my “itchy-finger” portfolio, where I take calculated swing trades and hunt for alpha. Any excess returns from this portfolio either get funnelled back into Bitcoin/gold (which is always the main goal) or used to fund lifestyle upgrades - like travel, tech, or home improvements. This structure keeps me both grounded and agile.

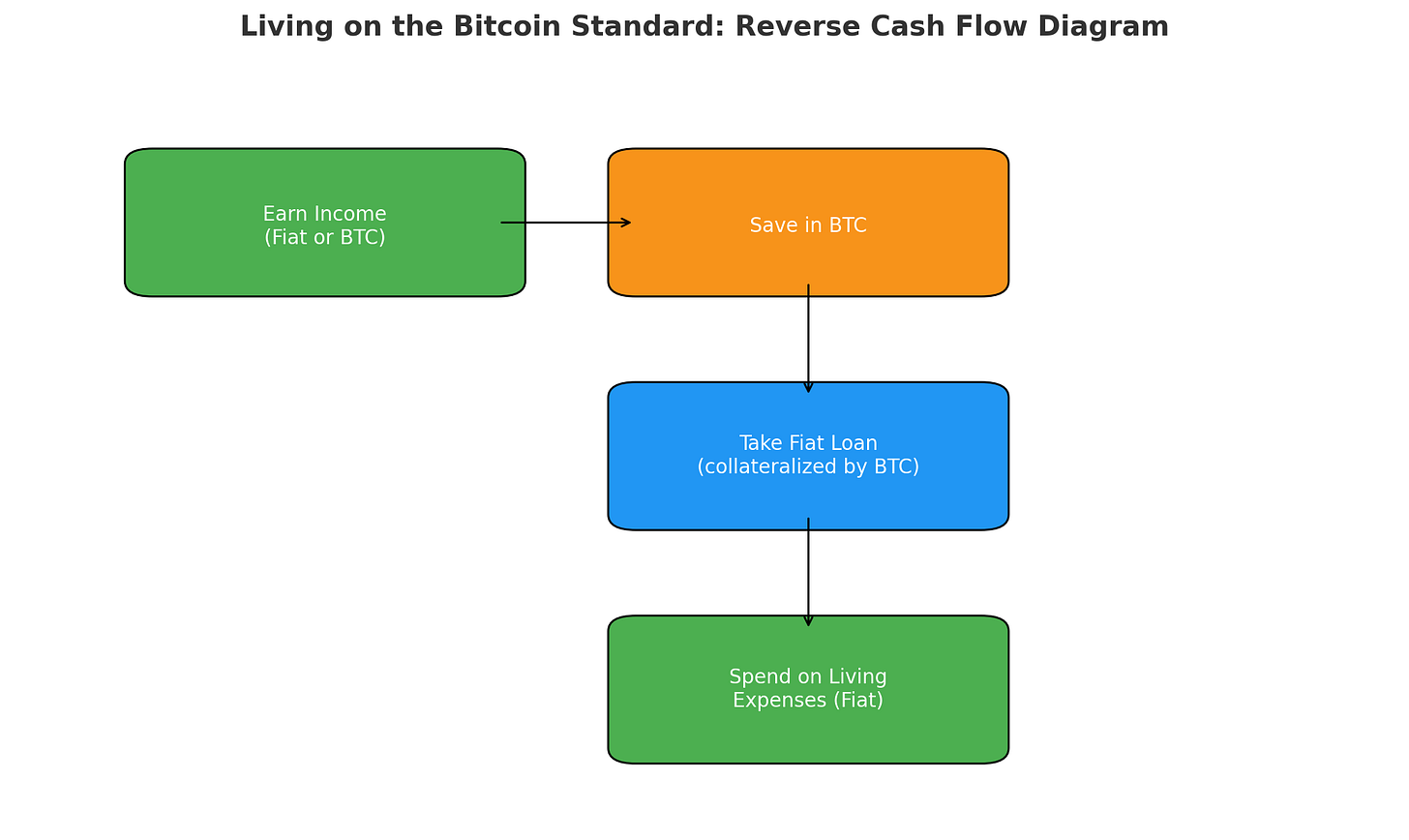

Living on the Bitcoin Standard

Of course, these weightings can be tweaked up or down depending on your tolerance for risk. One could live on the Bitcoin Standard and keep 100% of their net worth denominated in Bitcoin. Their incomes are converted to Bitcoin and they can borrow a loan against their Bitcoin to cover daily living expenses without selling their Bitcoin.

For me personally, I only keep an “itchy-finger” portfolio because it’s fun to swing trade for short term profits (I know myself) and it’s a fun challenge to accelerate returns to ultimately grow my Bitcoin stack.

Why I like this portfolio theory:

It has the passive elegance and simplicity of Ramit’s portfolio, but rather than dollar cost averaging (DCA-ing) into ETFs, you DCA into Bitcoin instead

It has the non-fiat resistance inclusion from the Radical Portfolio Theory, but with the resistance assets of Bitcoin and gold being liquid

To the “layperson”, it’s probably unpopular, and very contrarian - which ironically gives me more comfort

What about yield?

If you’re looking for income in your portfolio, here’s what I’d avoid:

US 1-year Treasuries: ~4% nominal yield → negative real returns after inflation and monetary debasement

Singapore savings bonds or high-interest rate savings accounts: ~2.3% nominal → again, negative real returns after inflation and monetary debasement

What about dividend stocks?

It depends. Yes, you can find 5-6% yields in banks and REITs, but that yield alone won’t protect you from inflation nor monetary debasement. More importantly, dividend stocks aren’t true income securities, the underlying equity value can go up or down, and your “income” can vanish overnight if the business falters. You’ll need to be selective e.g. like looking for signs of dividend per share (DPS) growth, etc. This requires extra work if you have the bandwidth.

And even then, structural headwinds loom:

Banks may be at risk in a new world of stablecoins and decentralised finance

REITs could suffer if AI and remote work lead to a permanent reduction in white-collar office demand

That said, I’d make an exception for quasi-government entities like DBS. In major market dips, you could potentially lock in a 7%+ yield, and if you hold long enough and reinvest your dividends, the equity appreciation + dividends might net you a 20%+ CAGR over time. Yum yum.

A Note on Real Estate

I haven’t included real estate in this portfolio because it’s highly country-specific.

For example, Singapore’s housing system subsidises mortgages for first-time local buyers - making it a savvy buy in most cases. But in general, I’ve typically preferred a “rent-vesting” approach, where you:

Rent the place you live in (typically pay a 2–3% rental yield)

Invest in rental properties with higher yields (4–5% depending on leverage)

Refinance those investment properties once they appreciate, and extract equity to redeploy into higher-returning assets

That said, I don’t fault anyone for buying their own home. It’s often more of a lifestyle decision than a financial one. During disruptive times like Covid-19, having a stable place to return to and being with people you love, can be invaluable. And the freedom to live on your own terms without being at the mercy of landlords and worrying about rent hikes or sudden lease changes - you simply can’t put a price on that.

A Note on Fiat Currency

Beyond monetary debasement, there’s also the risk of currency devaluation. If you believe the US is losing its grip as the dominant global power, and especially with the Trump administration pushing for aggressive industrial re-shoring - then it's reasonable to expect the USD to structurally weaken over the next few years.

In that context, I prefer to hold non-USD versions of the same asset, where possible. For example, I’d rather own GSD (the Singapore Exchange-listed gold ETF, denominated in SGD) than GLD (the US-listed equivalent). Same underlying asset but different currency exposure.